I have had countless conversations with clients in which the entire focus quickly became how much they disliked, discredited and hated coupon affiliates

Coupon affiliates. These two words alone are enough to drive some of us crazy.

There is definitely a lot of emotion attached to coupon affiliate programs. Many ecommerce companies are annoyed that this category of affiliate marketing even exists.

Now, there’s a lot of real-world experience that adds to the belief that coupon affiliates do not add any value. I’ve also been quite frustrated by coupon sites.

we owe it to ourselves to explore the bigger questions about how we choose which affiliates to work with

No matter where you currently fall on the “love-hate coupon affiliates” spectrum, we owe it to ourselves to explore the bigger questions about how we choose which affiliates to work with.

Are we left to rely on feelings when evaluating partner performance and the overall value of an affiliate or even an entire affiliate category?

Is our gut the only thing we have at our disposal to help us make good budget allocation decisions?

I know for me, in my own life, purely emotional decisions are usually reactive in nature. I end up missing quite a lot when I operate solely from an emotional mindset. I love using data for this reason. It’s clear, at least usually. It has no emotion tied to it. And when we look at it objectively, we usually make better decisions. The data on coupon publishers has to be out there, right?

There has to be some data we can look at to determine the value of the coupon affiliate, yet this data is often missing when planning an affiliate marketing strategy.

So, in an effort to get more clarity on this issue, I reached out to the JEBCommerce team and other leaders in the affiliate marketing industry gathering data to shed some light on coupon affiliate programs.

Read what we discovered below or download the coupon affiliate case study here.

Types of Coupon Affiliate Programs

grouping all the coupon-type affiliates into one “coupon” category really no longer works

First thing we learned is that grouping all coupon affiliate programs into one category is not accurate. There are four coupon affiliate programs:

- Paid search arbitrators: affiliates who want trademark terms to bid on; a better way to describe them may be “search affiliates.”

- Best of web deal sites: cultivate the best deals on the web for many categories; creating an environment where consumers discover new brands and products.

- Browser Plugins: like Honey

- Coupon aggregators: supply consumers with ALL the coupons

Paid search arbitrators can really be handled as paid search affiliates.

Best of web deal sites are perceived to do quite a bit more than the others to introduce new brands and products to their user base and provide a different level of incrementality than the other two.

Advertisers in general seem to love best of web deal coupon sites. I believe it’s because they are perceived to be doing a lot more to generate incremental revenue, unique traffic to their sites and value to the advertiser.

Now, when we hear about the dreaded coupon sites taking credit for orders the ecommerce store already had, what we are really talking about are coupon aggregators.

Coupon aggregators seem to be where the majority of advertisers’ grumbles originate. Let’s take a deeper look at the common problems with coupon affiliate programs.

Diving into Coupon Affiliate Data

To reiterate, there are four main grievances that advertisers generally have with coupon sites:

- Coupons don’t provide incremental value.

- Coupons don’t actually do anything to win the user for the brand.

- Users search for a coupon after they have made a decision to purchase, increasing the advertiser’s cost and providing no value for that cost increase.

- Coupons lessen the brand in the eyes of the consumer.

In order to get to the bottom of how we form, and validate, our view of coupon affiliates, I looked to the JEB team and others in the industry.

During my research, I didn’t ask how anyone felt. Instead, I asked what data they had to show the value—or lack thereof—of coupon affiliate programs.

I reached out to all the major networks, the top 15 coupon-type affiliates, some unique affiliates that offer coupons, and a few of our clients.

Huge thank you to the networks: Linkconnector, Commission Junction, Linkshare and Partnerize for providing some amazing data, both broad and deep.

Coupon Affiliate Incremental Value

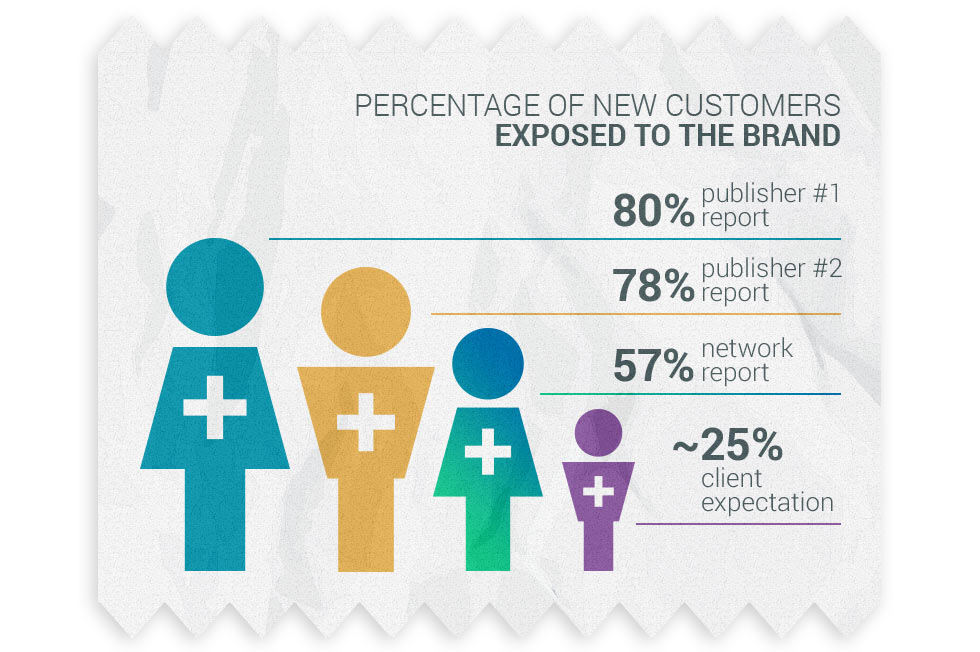

Here’s one of the first sets of data I uncovered in my research: A JEBCommerce client in the consumer goods category wanted to know how effective two of the biggest coupon affiliates were in driving sales they would not have had without them.

To be transparent, this client felt the coupon affiliates provided little value; it wanted them out.

One key measurement they use is new-to-file customers, or customers who have never shopped with their organization before.

For the period of Jan. 1 through Aug. 7 2018, the top coupon site—you know their name, and you most likely have a bit of disdain for them—generated 80% new customers through its site. That’s triple the client’s expectation.

The second biggest coupon/loyalty affiliate in the program generated 78% new customers.

After reviewing the data further, we discovered that the majority of the customers in each instance had no visibility into this brand prior to the click from both of these websites—more than 65% in both cases.

That’s a significant amount of new customers introduced and closed by these two affiliates. The client chose to keep those affiliates.

Incrementality of Coupon Affiliate Paid Search Traffic (%)

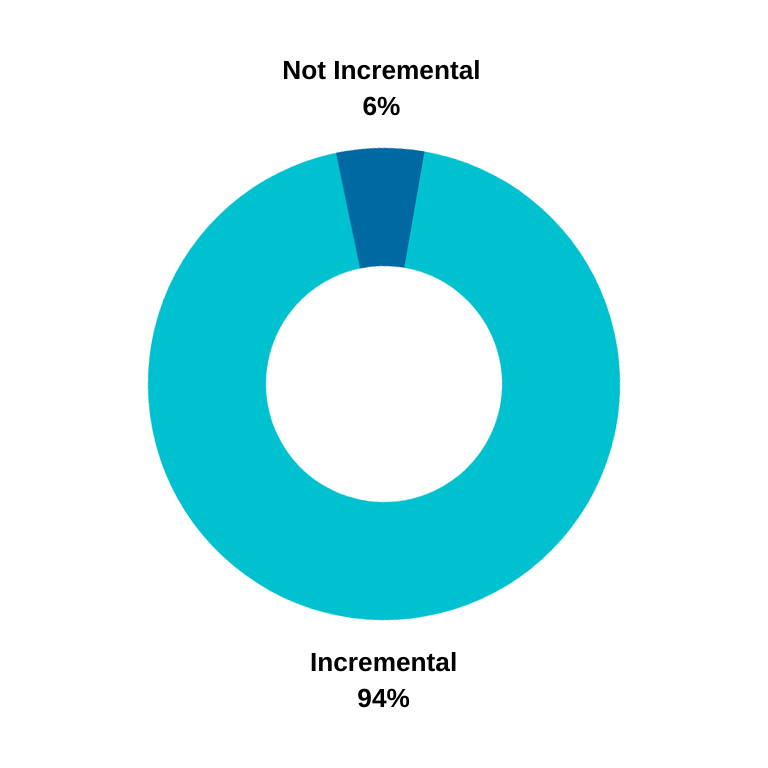

Comscore and Google released a much-anticipated study at CJU that spoke to this very issue (thanks to CJU for supplying this).

In the study, Google shared that 94% of transactions driven by coupon affiliate paid search ads were incremental—meaning, the customers were not already on the retailer’s site before they searched for a coupon. Just 6% of purchasers were already on the retailer site before clicking on a coupon ad.

94% of transactions driven by coupon affiliate paid search ads were incremental

When I saw that data, I really had to take a step back. 94% of transactions were incremental. They were not on the advertiser’s site.

It is important to note this is a study by Google and Comscore. Because one of the largest critiques of affiliate data sets is that they have been published by parties with an incentive to show the channel in a positive light.

I don’t believe this is the case for Google or Comscore; I think it’s safe to trust that data.

And finally, this challenges the biggest knock on coupon affiliates: that they are only there after the purchase decision is made as the user leaves the cart, goes to find a coupon, then reenters the cart through an affiliate link, allowing said affiliate to get the credit.

Under that common argument, no value is created by the coupon affiliate.

coupon site-originated purchases were 57% more likely to be new users

Google and Comscore data shows overwhelmingly that that is not the case. Compelling data, isn’t it?

Partnerize also shared some data along these lines with me. Across their platform, coupon site-originated purchases were 57% more likely to be new users than customers who converted from other channels.

Measuring incrementality by size of the order.

Do coupon affiliate orders tend to be larger or smaller than other affiliates’ orders? Do they have more items per order?

Essentially, we can frame the question this way: Do coupon affiliate customers purchase more or exhibit more favorable purchasing behavior than the customers from other type of affiliates?

The team at Linkconnector shared a tremendous amount of data for this article. In regard to incrementality, they reported the following:

- AOV is 14% higher when a coupon is used, network-wide

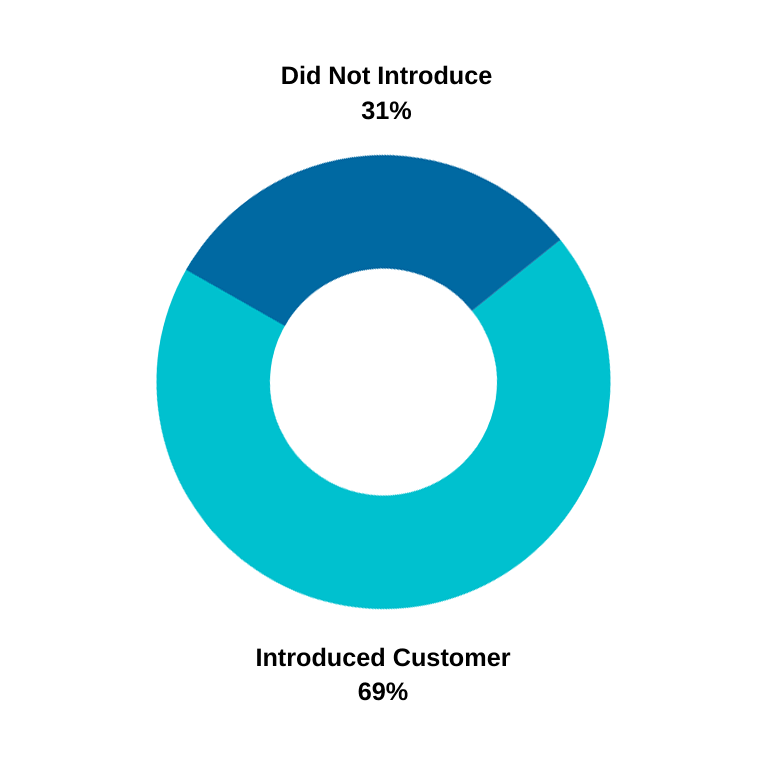

- 69% of events from coupon affiliates involve some sort of coupon

- 31% of purchases from coupon affiliates are full-price buyers

In other words, 31% are not shoppers who are only looking for a deal. Nearly 1 in 3 are full-price, non-discount purchasers.

Coupon shoppers who clicked on a coupon ad were more than twice as likely to purchase

The Google/Comscore report sheds additional light on the issue, finding that over a six-month period:

- 26% of coupon users completed two more transactions, from the same retailer, than non-coupon users

- 27% of those coupon users completed three more transactions, again from the same retailer, than non-coupon users

- 33% of those coupon users completed four more transactions from the same retailer than non-coupon users

- Advertisers realized 5% more revenue per coupon user when compared to general shoppers over a six-month period

Coupon shoppers who clicked on a coupon ad were more than twice as likely to purchase and convert on an advertiser’s site! Again, this comes from the Comscore/Google study.

Coupon Affiliates and Commission Stealing

Another often-discussed area of performance within the affiliate channel is the customer’s path to purchase. Do coupon affiliates only come in at the end to “steal” a commission after the consumer is already on the site, or are they a bigger part of the process?

To dive deeper into the issue, let’s see what the data shows. Linkconnector provided a wealth of information on the behaviors of customers shopping through advertisers on its network. Here’s a bit more of that data:

- Coupon affiliates are an introducer in the purchase funnel 27% of the time when multi-credit events are in play (LinkConnector’s clickstream data)

- 69% of the time, cookies from coupon affiliates occurred before the user entered the shopping cart window, meaning they introduced and promoted the user to the cart in more than 2 of 3 cases. If you value introducers, it’s also important to note that two-thirds of coupon purchases could be introduced by that same coupon affiliate.

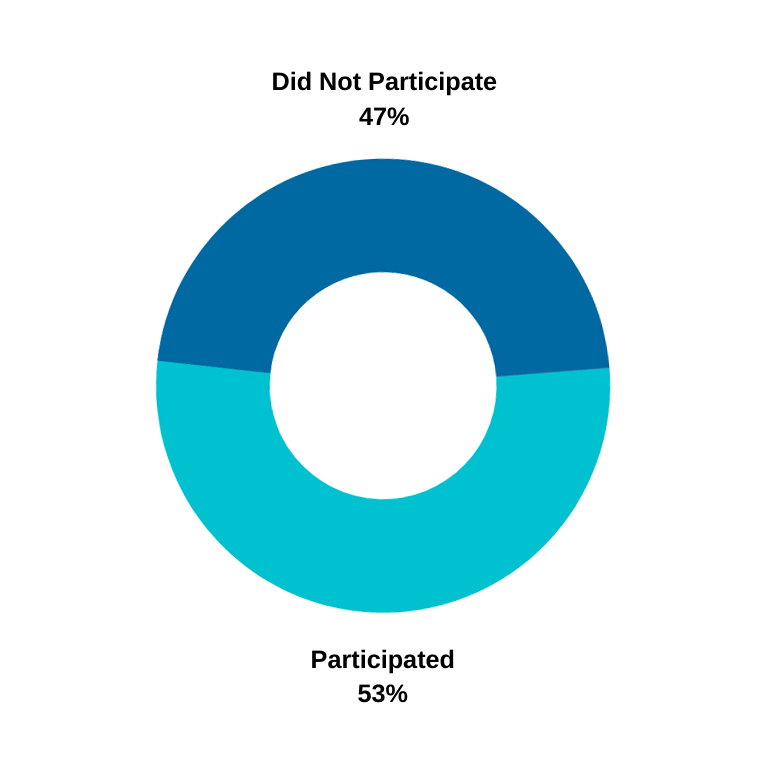

- Coupon affiliates were part of purchase funnel (outside of being a closer) 53% of the time. (LinkConnector’s clickstream data)

Based on the third bullet point above, it’s safe to say the coupon affiliates contributed, influenced or introduced—but did not close—the deal.

Introduced & promoted user to cart (%)

Participation in purchase funnel (%)

rarely, if ever, is there discussion on when (coupon) affiliates introduce and influence

A personal note on this point: When the discussion of category value comes up, the issue of coupon affiliates closing the deal when others have introduced and influenced almost always comes up. But rarely, if ever, is there discussion on when these affiliates introduce and influence but don’t close. Shouldn’t it go both ways when determine value of a partnership?

Within this discussion of path to purchase is the concept of cart sniping, discussed above as stealing commissions after the consumer is already on the site. Partnerize was kind enough to wrap a bit of narrative around its data:

TIME TO CONVERSION: We use time to conversion as a measure of whether people are visiting a coupon site after, say, deciding what and where they are going to buy, in order to see if there is an available discount. The prevailing assumption among those who believe that coupon sites are subsidizing current users is that the time to conversion would be quite short.

So, for instance, if the time to conversion were 10 minutes, we could perhaps assume that people were engaging in the unwanted behavior described above. That is NOT the case. The average time to conversion, while shorter than the average for other types of sites, is still almost a full day (18 hours).”

Coupon Affiliate and Brand Perception

One of the downsides of coupon affiliates cited by those of us who don’t like working with them is that it diminishes the brand’s identity in the mind of the consumer. But if you look at the data on general coupon behavior below, is that actually true?

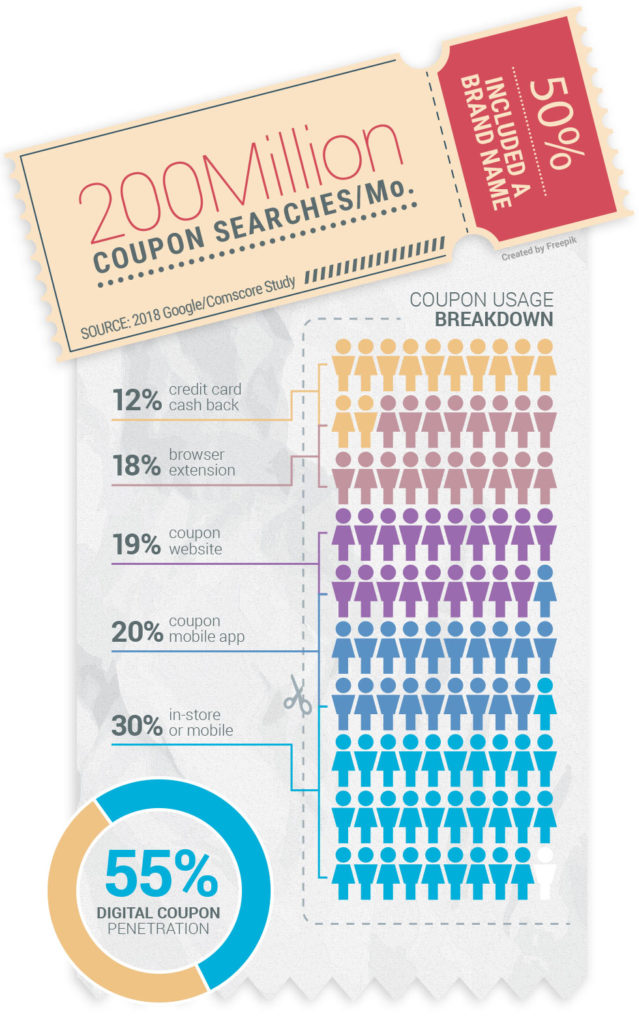

Here’s some data from the Google/Comscore study:

- 200 million coupon searches in Google each month

- More than 50% of those contain a brand name

- Digital coupon penetration is estimated to reach 55% of the U.S. population

- Customer-preferred coupon usage breakdown

- 30% prefer in store/mobile

- 20% coupon app

- 19% coupon website

- 18% browser extension

- 12% credit card cash back offers

Here’s LinkConnector data on general coupon behavior:

- 54% of transactions in LinkConnector have a coupon involved, across all affiliates (not just coupon affiliates)

- when a coupon is used in a transaction, only 48% of those transactions are attributable to a LinkConnector affiliate

- When a coupon is used, and it is attributable to a LinkConnector affiliate, 41% are private coupons—private to only one affiliate created by the merchant

And again from our friends at Partnerize:

PURCHASE REJECTION RATE: We sometimes think of the rejection rate for conversions as a measure of the quality of traffic and data from partners. Accepted or valid sales are an indicator that the site delivers real, authenticated purchases. As you know, in our industry rejection rates tend to be quite low across all major publishers. That is great evidence of the quality of our category.

Further, when we compared the rejection rate for purchases made from coupon sites versus other sites, we saw that coupon site rejection rates were 25% LOWER than average. I believe that this is because coupon sites tend to be that largest and most sophisticated affiliates.

So does it really diminish the brand if so many of consumers are searching for and redeeming coupons?

Rethinking Coupon Affiliate Programs

Our research dug up quite a bit of real data around coupon affiliates. Some key takeaways:

- Sales driven by coupon customers are more incremental than previously thought (as reported by several different organizations including Google, Linkshare, Linkconnector and Partnerize)

- Paid coupon search ads play an important role in engaging shoppers and encouraging them to take action (aka, convert)

- Coupon sites also influence and introduce customers to new brands

- Coupon sites can be a huge new customer acquisition tool

- The data in this article offers very compelling evidence that coupon affiliates are not stealing commissions at the end of the purchase path, but in fact introducing new users and converting them for the advertiser

- We may be making emotional decisions about a large category of affiliates and not taking into account data that often shows coupon affiliates produce more value than given credit for

Coupon affiliates. You probably began this article not thinking very highly of this category. And perhaps you’re still not a fan. But is this data compelling? Has it changed your mind in any way?

Now, we all have to make our own decisions on budget spends in order to achieve our financial goals and some level of spend efficiency.

My hope is that I’ve provided some compelling and interesting data that you can incorporate in your budget decisions to grow a large and profitable affiliate program.

If you need any help determining the right affiliate publisher mix or whether your affiliate program is profitable or not, let us know. We’d love to help you!

And again, a special thank you to the teams at Linkconnector, Commission Junction, Rakuten Marketing, and Partnerize for sharing such thorough and compelling data.