In her first of a multi-part series, our Vice President of Global Performance Marketing, Joanna Culbertson, takes on why to expand your business globally. Follow this series as she lays out why, when, where and how to expand your business beyond your home market!

Why

As we all approach the halfway point in 2014 and things are progressing well with your ecommerce site, you may be looking for your next steps, next opportunity, next move or next challenge in your business growth journey.

With the flattening of new online user adoption in the US it may be beneficial to consider taking your business global – after all this is the World Wide Web, right?

Here is a quick overview of the current health of online retail for the UK, EU, APAC and Canada.

UK – EU

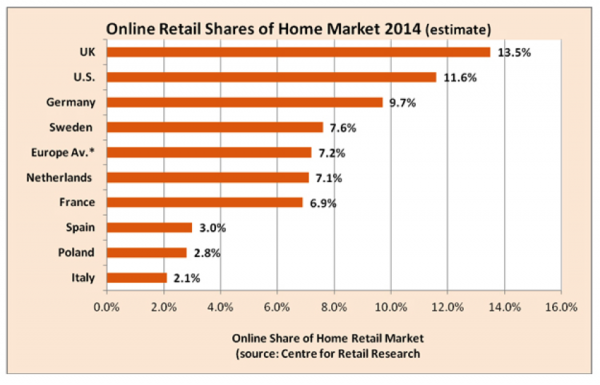

Online sales in the US are still growing – currently a 15% increase in first Quarter 2014 versus first Quarter 2013. E-commerce sales for the US in the first quarter of 2014 accounted for 6.2% of total retail sales (US Census Bureau).While this is great news for US e-commerce sites, there are other countries where online retail currently logs a higher share of sales proportionately.

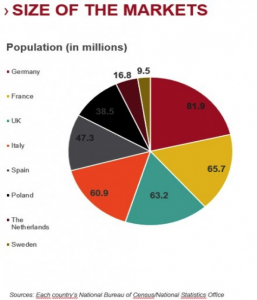

Yes, the UK has currently surpassed the US in overall online sales share. The UK online sales market share is even more impressive when you take into consideration that it is 3rd in population in the EU online market place.

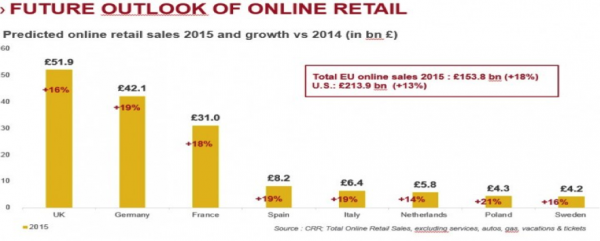

Predictions have UK retailers set to take in £45bn this year in online sales as consumers are set to spend more than £1,000 each on the internet. The UK was the largest market in Europe, with sales of £38.8bn 2013, and is expected to account for more than a third (34%) of all online retail sales in the eight EU Markets surveyed in 2014.

According to research commissioned by RetailMeNot, the world’s largest digital coupon marketplace , online sales will grow by 16% in the UK as UK shoppers will make, on average 18 purchases a year – an average of one purchase every 3 weeks.

Asia – Pacific

According to eMarketer’s latest forecasts, worldwide business-to-consumer (B2C) ecommerce sales will increase by 20.1% this year to reach $1.5 trillion. Growth will come primarily from the rapidly expanding online and mobile user bases in emerging markets, increases in ecommerce sales, advancement in shipping and payment options, and the push into new international markets by major brands.

In 2014 for the first time, consumers in Asia-Pacific will spend more on ecommerce purchases than those in North America, making it the largest regional ecommerce market in the world. This year alone, B2C ecommerce sales are expected to reach $525.2 billion in the region, compared with $482.6 billion in North America. China has already exceeded predictions and surpassed in 2013 rather than 2017 the US in growth of online use. The Asian countries, along with Argentina, Mexico, Brazil, Russia, Italy and Canada, will drive ecommerce sales growth worldwide.

The strength of sales in emerging markets is largely due to their large populations coming online and first time buyers due to an increasing middle class. Asia-Pacific is projected to claim more than 46% of digital buyers worldwide in 2014, though these users will only account for 16.9% of the region’s population.

Canada

In 2014, according to ETC (EuropeanTravelCommission) in addition to the U.S., the Canadian ecommerce market shows impressive growth. In 2014, ecommerce is predicted to grow by 14% and reach nearly $35.7 billion. Canadian online buyers are very adept in cross-border shopping – 33% of all their purchases, have been made on US website, 8% on Asian websites and 3% on European ones. The primary driver for cross-border purchases is cheaper prices, followed by selection and discounted shopping.

Canadian consumers are among the most highly engaged worldwide. Canadians exceed the U.S. in terms of average monthly visits per visitors, with 88 monthly visits in the fourth quarter of 2013. The US did surpass Canada in 2013 in terms of web pages visited per month, although internet users in Canada visited an average of 3,001 web pages per month during the fourth quarter of 2013, whereas US consumers visited an average of 3,162 pages per month in the fourth quarter of 2013. The U.S still outranks Canadian consumers in hours spent online – 36.2 hours per month online versus 34.6 hours. However, both countries still surpass the worldwide average of 24.2 hours per month.

Australia/New Zealand

Online shoppers in Australia spend more on average per order than anyone else in the world, at $142 in 2013; up 20% from 2011 (CMO.com.au) Global players still dominate Australian online shopping due to being early movers in this country’s internet retailing. Traditional domestic retailers are finally adding the online channel to their business models. Consumers have also become more relaxed and feel more secure with online shopping in addition to a higher broadband connection rate and growth in mobile device use.

According to a report by the BNZ, online purchases in April 2014 made by New Zealanders with international merchants increased 17% over April 2013. International merchants continue to build their sales and presence in the marketplace generating over 40% of online retail sales – a 2% increase over 2013 for the same period.

Considering all of the above data, why would you not at least dip your toe into the international ecommerce waters? Remember the first adapters always secure the strongest footholds and have more opportunities to build their brand and carve out their unique niche. Check back next week for the next steps of the Where, When and How of global e-commerce expansion.

– Joanna, VP Global Performance Marketing